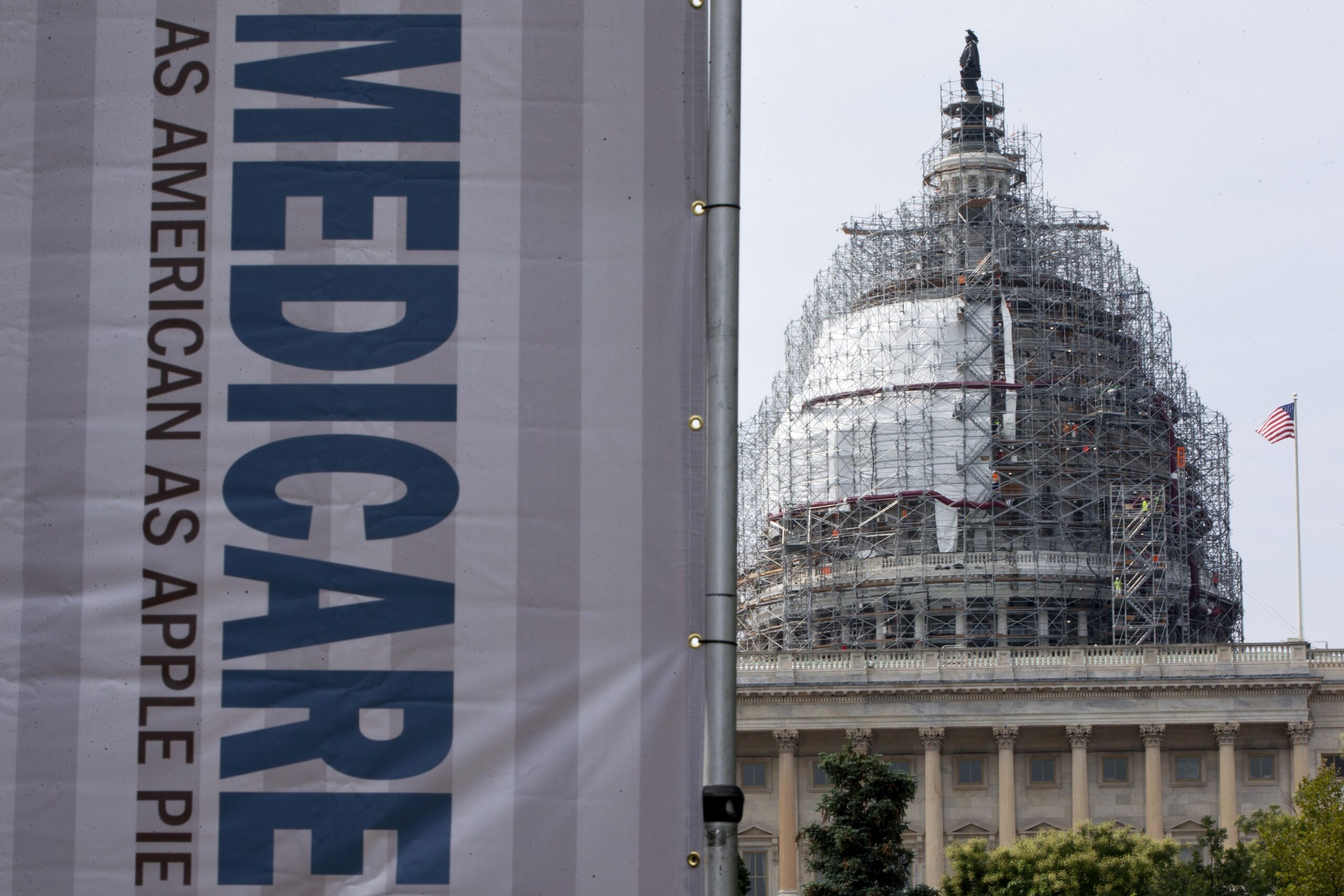

A battle is brewing between the Centers for Medicare and Medicaid and major insurance companies as Medicare Advantage plans could receive reduced payments next year. Such a move could cut into profit margins unless insurers cut back on benefits to Medicare Advantage plan holders. The proposal would change the way Medicare pays insurers. A “risk adjustment†would give insurers more money for those who are sicker as they will generate higher expenses. However, the new proposal would either eliminate or reduce payments for some conditions such as atherosclerosis (plaque build up) and a specific type of malnutrition. The government says this will result in more money for insurance companies but Medicare Advantage plans think differently